WeGolden Copy Trading

Follow, copy, and earn by syncing successful traders’ strategies through the WeGolden all-in-one trading ecosystem.

Copiers

150K+

Successful Copy Trades

6M+

Signal Master Traders

32K+

About WeGolden Copy Trading

What Is Copy Trading?

Copy Trading is a trading strategy and function which automatically replicates the trades of experienced and successful traders. Individuals can potentially benefit from their expertise, insights, and strategies without requiring extensive trading knowledge or experience.

For Master Traders

Users who publicly share their trades for other users to copy.

Advantages of a Master Traders

- Multiple streams of income

- Flexible profit-sharing model & short settlement period

- Build a reputation and grow follower base

For Followers

Users who copy the publicly shared trades of Signal Master Traders.

Advantages of a Followers

- Novice traders can learn and sync up with the pros

- Wide range of Master Traders to suit your preference

- Save time and earn passive income seamlessly

How do we work

How Does WeGolden Copy Trading Work?

Follower

Master Traders

Drag to explore

Step 1

Open an account

Get ready to maneuver the financial market's horizons. Log in to your copy trading account using your MT5 details.

Step 2

Choose Your Captain

Our platform allows you to conveniently view the past performance of master traders. Subscribe after selecting the ones whose goals align with yours.

Start trade now!

Step 3

Chart Your Course

Choose your captains, and you stay in control. Monitor your portfolio and adjust it according to your objectives.

Start trade now!

Drag to explore

Step 1

Create an WeGolden Account

Login to our copy trading and choose to become a Master Traders.

Step 2

Showcase Your Expertise

Share your proven strategies and insights with a wider audience.

Start trade now!

Step 3

Build Your Crew

Attract followers who are eager to learn from your experience and replicate your trades.

Start trade now!

Why Choose Us?

Why choose WeGolden

Copy Trading

Follower

Master Traders

*You can view the table by scrolling left and right.

| Follower | WeGolden | Other Brokers |

|---|---|---|

|

Beginner-FriendlyChoose a signal provider, set your risk, allocate funds, and let the system handle everything. |

|

|

|

Transparent & Comprehensive DataAccess detailed signal provider performance history and track your copied trades in real time. |

|

|

Fair Profit SharingWe use the High Water Mark + Floating Orders method to ensure profit sharing occurs only during continous gains |

|

|

Flexible Signal SourcesChoose from multiple signal Master Traders and start or stop copying anytime. |

|

|

*You can view the table by scrolling left and right.

| Master Traders | WeGolden | Other Brokers |

|---|---|---|

|

Frequent Profit SettlementsAutomatic profit sharing every Saturday. |

|

|

|

Fair PayoutsStopping copying or withdrawing funds triggers settlement, ensuring signal providers are compensated. |

|

|

Flexible Profit SharingSignal providers can adjust their profit-sharing ratio anytime, up to 50%. |

|

|

Boosted VisibilityMultiple promotional channels help signal providers attract more copiers. |

|

|

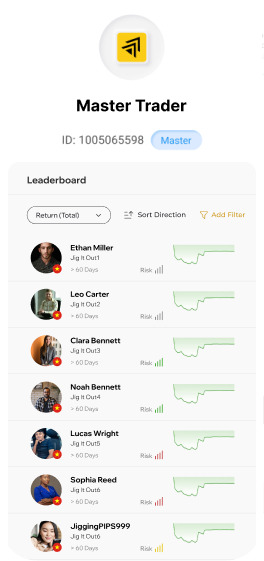

Top Traders

Choose your ideal strategy from top signal Master Traders based on your risk appetite and goals.

Comming soon

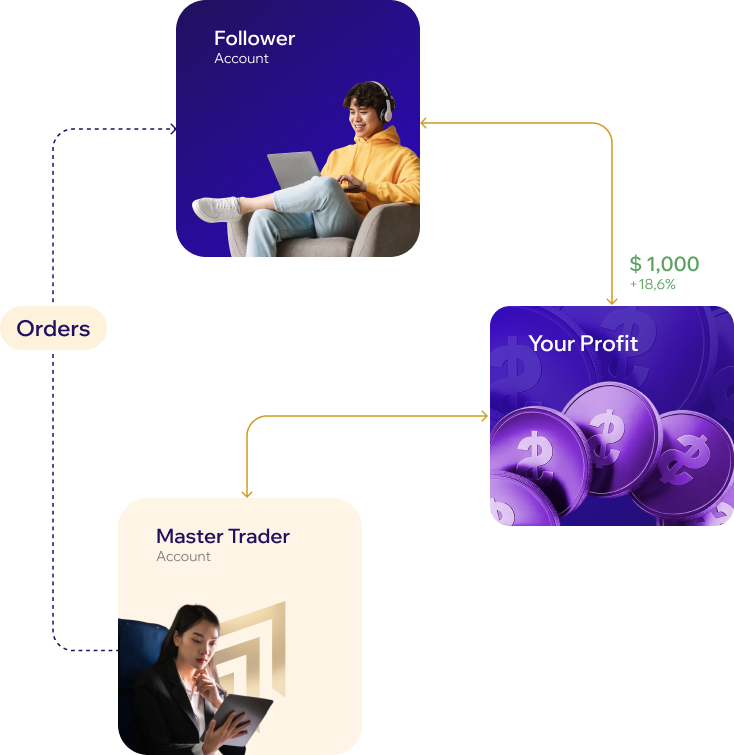

How to operate?

How It Works: Choose, Follow, Profit

Choose from experienced global trading masters. Top trading strategies are at your fingertips, you can view and decide in real-time whether to replicate their trades as followers.

FAQs

Frequently Asked Questions

How Profitable is Copy Trading?

The profit levels of copy trading depend on the trader, market conditions, and the copy trading system being used. Chances are that you will achieve steady returns if you choose a convincingly successful trader and implement risk management strategies. Keep in mind, though, that historical performance is not a guarantee of future performance, and losses are always possible. Many platforms provide a demo account of copy trading, where you can test profitability without risking real money.

How Profitable is Is Copy Trading Legal?Copy Trading?

Yes, copy trading is legal in most countries, as long as the copy trading brokers are regulated. The platforms offering copy trading services all work within financial regulations to provide full transparency and protection for traders. Still, before you start, ensure that the platform and traders you are going to copy comply with the financial laws of your country.

How Does Copy Trading Work?

Copy trading allows you to copy professional investors' trades in real time. Through a copy trading system, you can automatically mirror all the trades made by a chosen trader. This therefore means that, with every move of the expert through opening or closing a position, your account mirrors the action taken proportionate to your investment. You can copy a variety of markets from it, such as forex, stocks, and commodities.

Is Copy Trading a Good Option?

Copy trading is an extremely good option for those who would like to approach the market with a little less intense strategy on trading. Such an approach appeals more to starters who prefer to be part of the markets despite their lack of expertise and experience in them. Though it is very profitable and time-efficient, it's still not 100 percent risk-free. Be very careful in choosing the people whose trades you want to copy and always beware of the risks.

What Are the Risks Associated with Copy Trading?

Like all investment strategies, copy trading is not without risk. Some of the leading risks include:

- Market Risk: Even for a highly experienced trader, losses may take place. This means that you might lose your money.

- Over-Reliance on One Trader: Copying one trader can expose you to quite a high risk if their strategies fail.

- System Errors: Technical errors from the copy trading system or platform might result in involuntary trades or lost opportunities.

- It’s essential to diversify by copying multiple traders and setting personal risk parameters.

Can Beginners Start with Copy Trading?

Absolutely! Copy trading is the best entry point because one will be learning from experienced traders who understand different markets. Master Traders of forex copy trading services typically have a demo account and all other tools specifically for beginners, this way you can run a zero-risk configuration. A beginner must start small and gradually increase their exposure as one gets familiar with the process.

How can I Choose the Best Trader to Copy?

Selecting the right trader is essential for success in copy trading. Before making a decision, consider the following factors:

Performance History: Choose traders with a consistent and proven track record of long-term profitability rather than short-term gains.

Risk Profile: Ensure the trader’s risk level aligns with your own tolerance. Higher returns often come with higher volatility and potential drawdowns.

Diversification: Consider traders who operate across different markets such as stocks, forex, or commodities to help spread risk.

Fees: Review any commissions or performance-based fees, as these can directly affect your net returns.

Most copy trading platforms provide detailed statistics and analytics to help you evaluate traders and make informed decisions.

What Platforms Offer Copy Trading?

Several platforms offer reliable copy trading services, each with different features and markets. Among them are forex copy trading, stock trading, and many more. Some copy trading brokers also have a very friendly interface, elaborate trader analytics, and a demo copy trading account. Be sure to opt for clearly regulated and fee-transparent platforms.

Is It Possible to Lose Money with Copy Trading?

Yes, it is possible to lose money with copy trading. Although it provides the opportunity to capitalize on the expertise of successful traders, financial markets remain inherently volatile and unpredictable. As a result, losses can occur. To mitigate potential risks, investors should implement effective risk management strategies, diversify their portfolios, and consistently monitor the performance of the traders they follow.

What Fees Are Associated with Copy Trading?

The fees for copy trading vary depending on the platform and the trader you copy. Common fees include:

- Spreads: The spread is how much more you will pay to buy an asset than you can sell it for.

- Commissions: Some platforms or traders charge a commission on profits made through copy trading.

- Performance Fees: Some traders are going to charge a percentage of any profits you gain based on their strategies.

- Make sure to read the platform’s fee structure and the trader's terms before starting, as fees can impact your overall profitability.

How Do I Monitor My Copy Trading Performance?

Most copy trading services give you access to dashboards where you can monitor your portfolio in real-time. Key metrics include:

- Return on Investment (ROI): This will describe how much profit/loss your trades have generated.

- Drawdown: This measures the peak-to-trough decline in your portfolio, showing how much you risk losing at any point.

- Trade History: Going over past trades can help you in analyzing your performance and adjusting any strategies as needed.

- Regular monitoring will help you adjust your strategy, such as stopping a trader if they are performing poorly.